American Express has built its reputation on delivering exceptional value to cardholders, or at least, that’s what they used to do consistently.

Welcome bonuses have become frustratingly predictable. Adequate, sure, but hardly the exciting incentives that once made opening new cards feel worthwhile.

The Amex Offers programme has followed a similar trajectory. While it remains superior to competitors, the days of generous, universally available promotions are clearly in the rearview mirror.

The original Shop Small with its easy $50 potential? That level of accessibility feels almost quaint now.

Still, dismissing Amex Offers entirely would be premature. The programme continues to deliver meaningful value for cardholders who understand how to work within its increasingly targeted framework.

The key is adapting your expectations and strategy to match today’s reality rather than pining for the golden age that’s clearly passed.

What Are Amex Offers?

Amex Offers are special promotions offered to current cardholders.

It’s designed to provide additional rewards on top of regular earning rates and welcome bonuses.

You can get Amex Offers on cards that earn all sorts of types of rewards, including Membership Rewards, Aeroplan points, Bonvoy points, or cash back.

The Structure of an Amex Offer

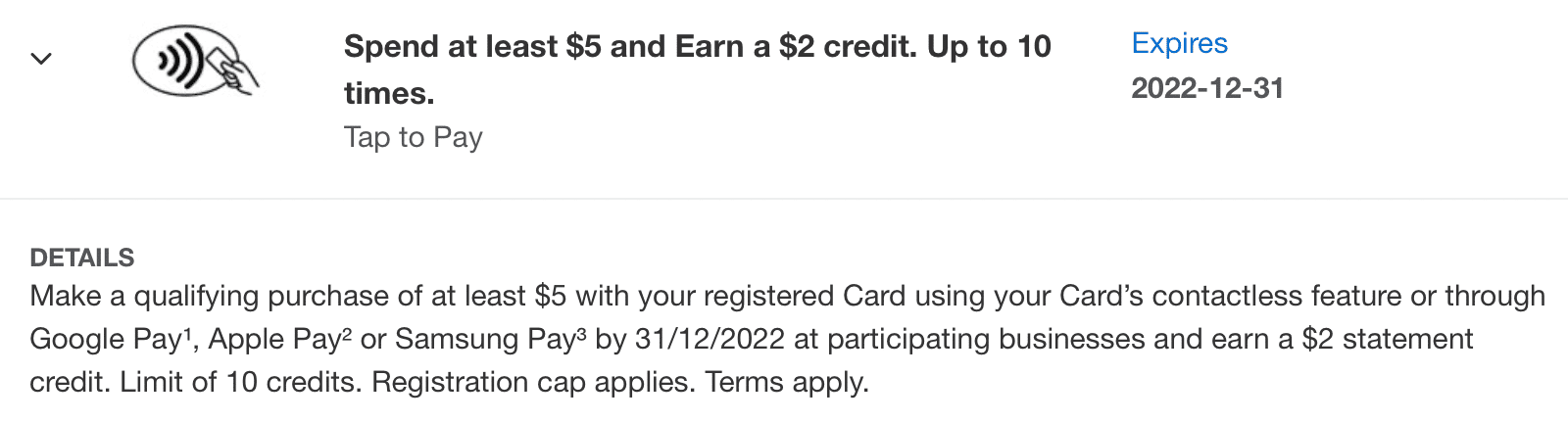

There are two main ways an Amex Offer’s requirements are structured: lump sum bonuses and boosted earn rates.

Also known as “Spend X, Get Y,” lump-sum bonuses trigger when you meet a required spend at an eligible merchant. These can range from a meagre $5–10 credit to subsidizing a decent chunk of a purchase worth hundreds.

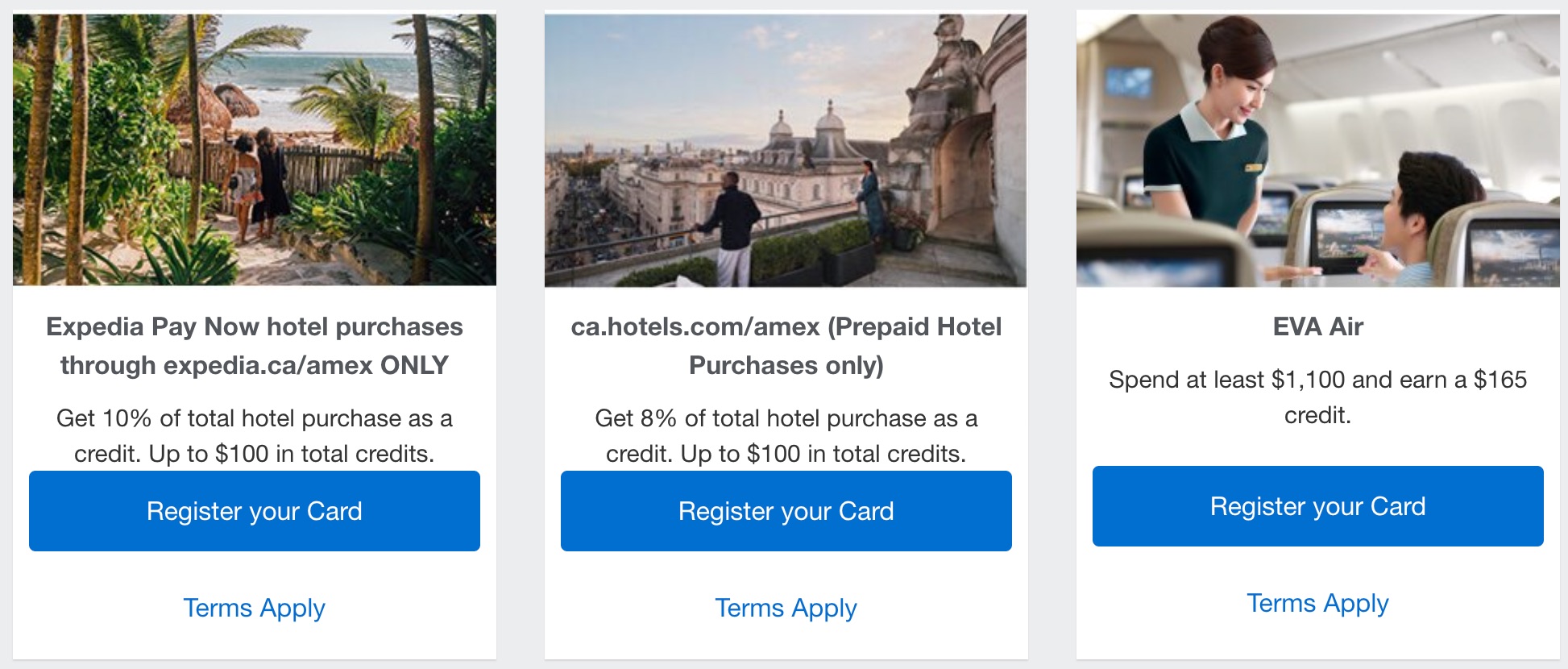

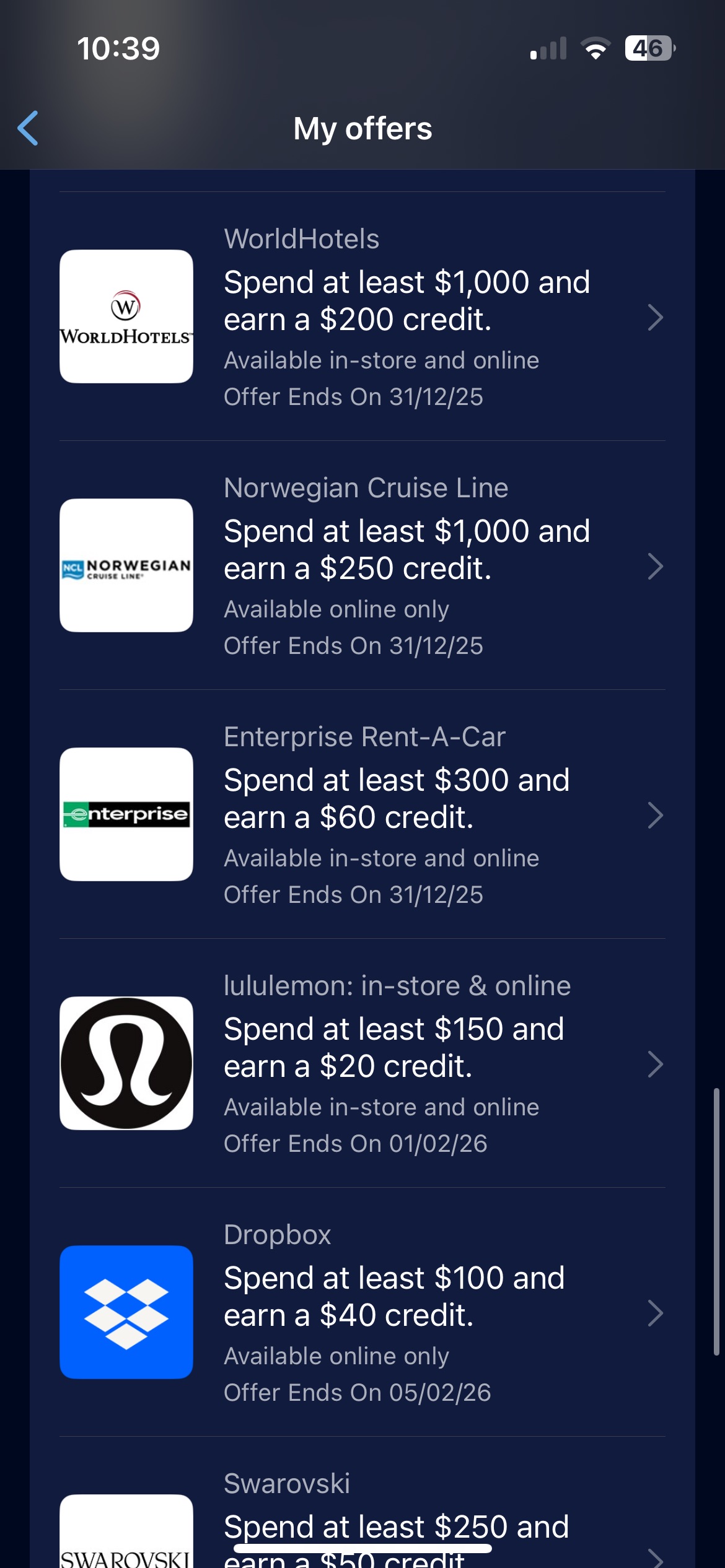

Here are a few examples:

Most offers require the qualifying spend in a single transaction, although some are cumulative and let you hit the threshold over multiple purchases.

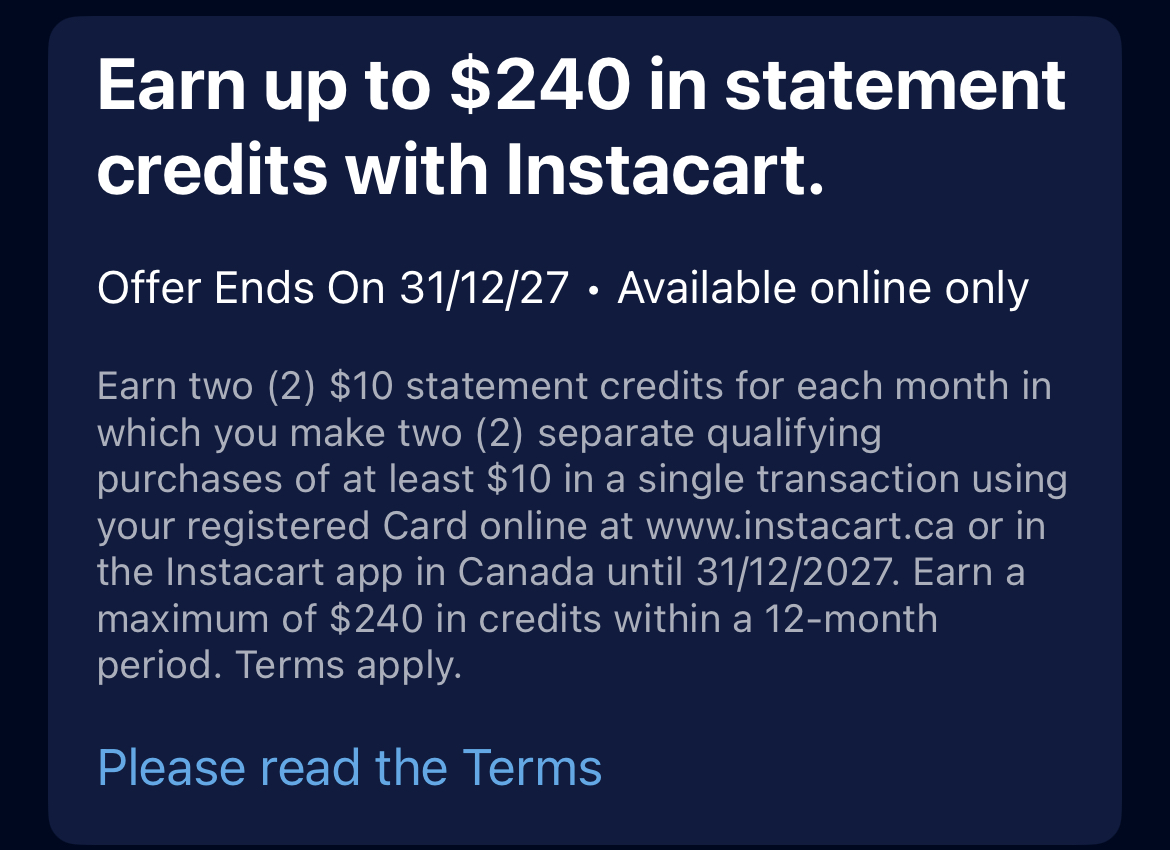

There are also sometimes recurring bonuses, like Shop Small or Instacart credits.

These usually aren’t cumulative on a single transaction, so you can’t earn two $10 Instacart credits on one $20 purchase.

Boosted earn rates work a bit differently, paying out a bonus until you reach a set maximum. Past examples include:

- Business Platinum 10x points (expired): earn 10 bonus points per dollar spent on all purchases, up to 25,000 bonus points or $2,500 spent

- Amazon 5x points: earn 5 bonus points per dollar spent at Amazon, up to 1,500 bonus points

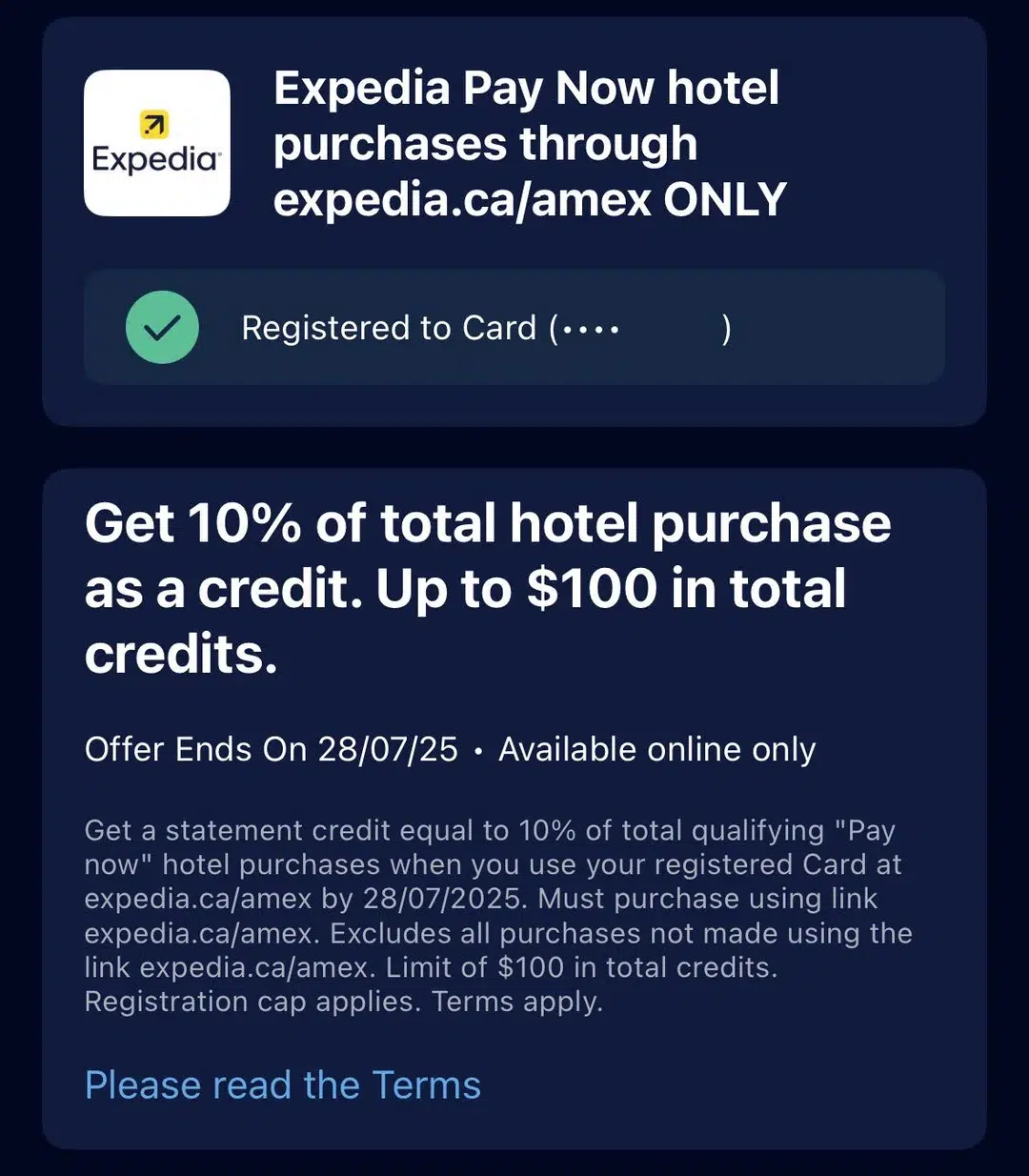

You may also see offers for a percentage cash back up to a specified maximum, such as the Expedia offer.

Each offer may require spending at a specific merchant, within a merchant category, or anywhere. Occasionally, the terms specify how you pay (contactless, online, or mobile wallet).

As always, check the fine print. Offers can have a registration cap, a registration deadline, and a completion deadline.

Sometimes there’s a special link for online purchases. While enforcement can be lax, using the link reduces the chance of issues later.

Who Is Eligible for Amex Offers?

Amex Canada

Some Amex Offers, like Instacart credits, are offered to all cardmembers with a certain product. When the ever-popular Shop Small promotion runs, it’s available for all cardholders with any Amex card.

However, many others are only offered to targeted cardholders. The United Airlines $250 credit and the Marriott Spend $500 get $100 back come to mind as two recent offers which were quite desirable but unfortunately seems to be more targeted lately.

The targeting algorithm is opaque, but it sure looks like Amex weighs factors such as your spending patterns, merchant mix, card type, tenure, and maybe how often you actually use past offers.

Other offers may be available on a variety of different products, but each member might see them on different cards. For example, I might get an offer on my Business Gold Card, while you may get the same one on your Aeroplan Card instead.

In any event, Amex Offers usually don’t start to show up on a new card until after the first few monthly statement cycles. There’s no tried and true method to get more Amex Offers, but generally speaking, the more you spend, the more promotions you’ll receive.

Amex US

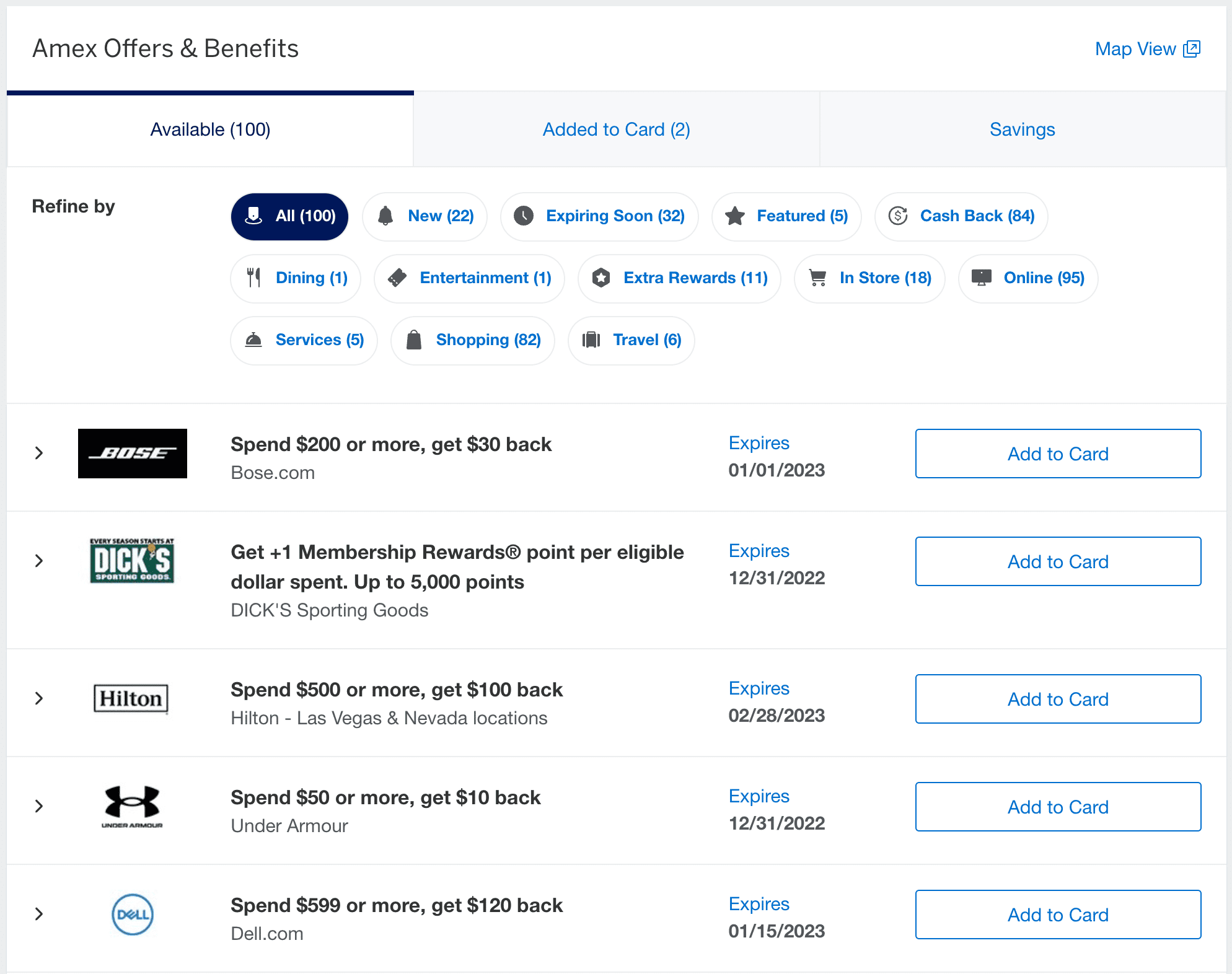

You’ll also get Amex Offers on your US credit cards. In fact, the program is way stronger there than in Canada, with up to 100 offers available on each card at any given time.

Because they partner with stores with a major American presence, it’s harder to derive value from many of these offers unless you’re shopping in the US.

As with all things stateside, terms and conditions tend to be enforced more strictly, so you might struggle to, say, use a “.com” offer with a company’s “.ca” online store.

Instead, keep an eye out for lucrative offers with travel providers, such as Marriott, Hilton, cruise lines, and other luxury resort properties.

If you’ve heard about an offer that you want but which isn’t available to you, try activating a few offers. Your list of available offers will immediately refill to 100 if there are others available, and ideally you’ll be offered the one you’re looking for.

Scotiabank

If you have a Scotiabank Amex card – issued by Scotiabank but using the Amex payment network – you’re also eligible for Amex Offers!

Since Scotiabank cards don’t use the Amex Bank of Canada online interface, there’s a separate landing page to register Amex Offers onto your Scotiabank cards.

Not all Amex Offers are available for Scotiabank cardholders, and not all cardholders are eligible for the same offers.

Note that you can’t register Amex-issued Amex cards this way. If you weren’t targeted for an offer you wanted, your best bet is to hope that the offer is available on this page, and register a Scotiabank Amex instead.

How to Use Amex Offers

You can view your Amex Offers on the main dashboard of your Amex online profile. Scroll down below your recent transactions and you can’t miss it.

You can also access your Amex Offers through a dedicated screen in the mobile app.

Review the list of available offers and register the ones you plan to use. Most Amex Offers are opt-in, so clicking “Add to Card” before you spend is the whole game.

Sometimes, Amex will also display other promotions here which don’t need to be activated, like an idle cardholder benefit or a referral bonus that they’re trying to advertise.

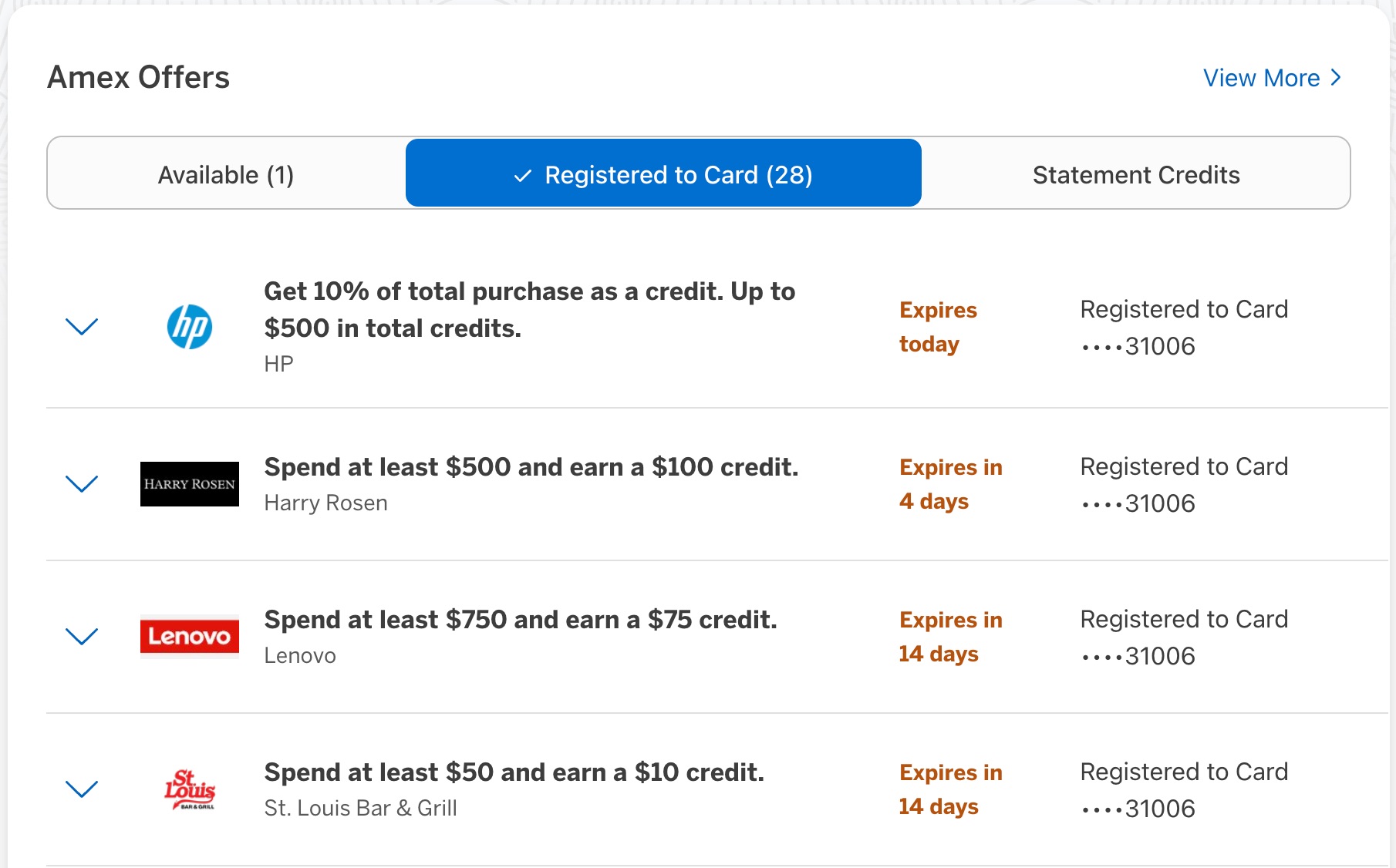

Flip to the “Registered” tab to track what you’ve already added, spot expiry dates, and plan purchases. As your Amex lineup grows, this tab is your memory.

Always use the exact card that has the offer attached. Your Platinum won’t trigger an Instacart credit that’s sitting on your Cobalt. I’ve made that mistake more than once, and no, Amex won’t sympathy-credit it.

If you have more than one Amex card, navigate between them to see each card’s distinct promotions.

For “Spend X, Get Y” thresholds, statement credits usually post within a few days, even if the terms say otherwise.

For boosted earn rates, bonus points post alongside base points once the transaction finalizes. Scotiabank-issued Amex credits tend to take a bit longer to show up.

Once an Amex Offer has been successfully redeemed, it may stay on your account, disappear from your account, or move to the Statement Credits tab.

It doesn’t seem to have any bearing on anything, and sometimes it happens before your bonus arrives. Just be sure you’ve met the qualifications properly and don’t be alarmed if you don’t receive your rewards instantly.

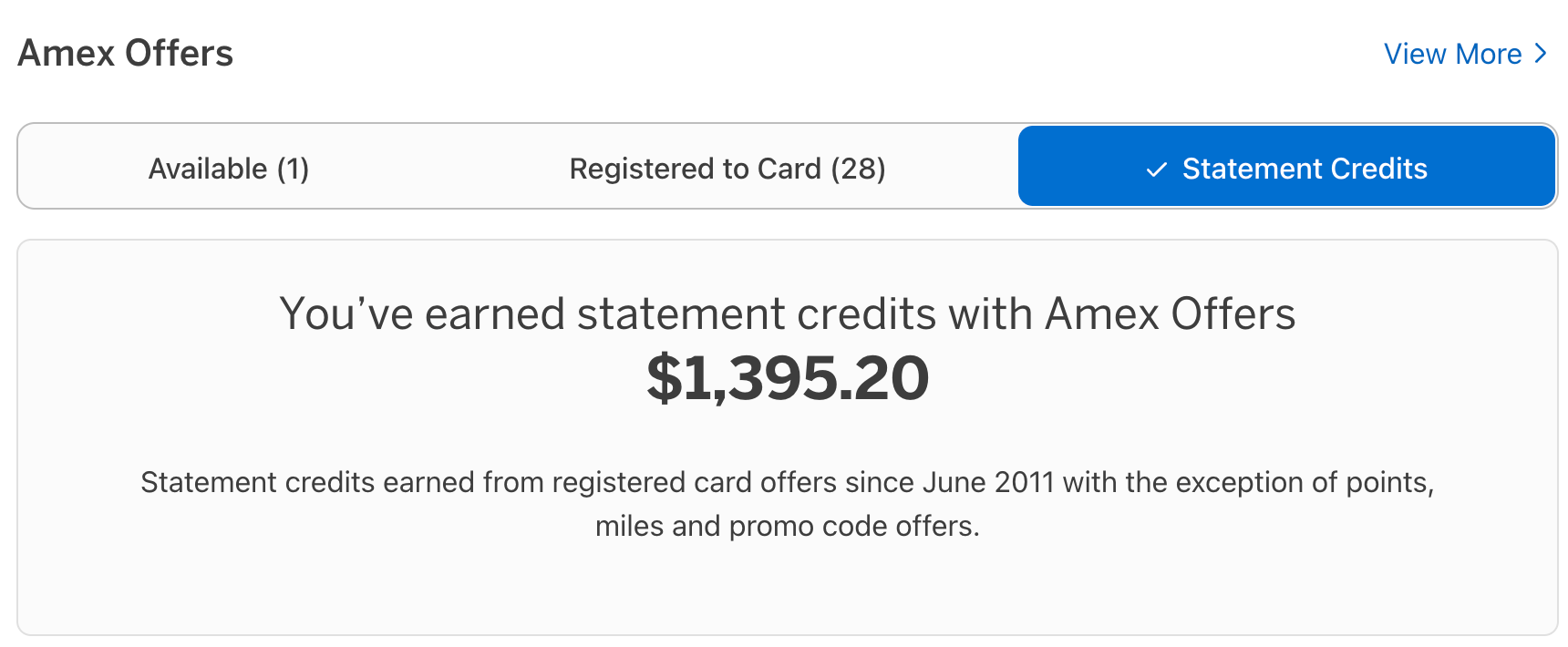

You also check to see how much you’ve earned from Amex Offers with each card by clicking on the “Statement Credits” tab.

It’s a useful gut check before renewal to decide if the card is still pulling its weight.

Why You Should Use Amex Offers

Signup bonuses on new credit cards receive a lot of attention. They’re fastest way to earn high-value rewards, and the strongest return both on the annual fees you pay and on the spending you put through the card.

Still, you can’t build a whole strategy on new cards. That’s where benefits for existing cardholders come in.

You can snag real lifestyle value at a discount. I picked up a Dell monitor few years ago, thanks to an Amex Offer I wouldn’t have otherwise considered, and I’m still glad I did.

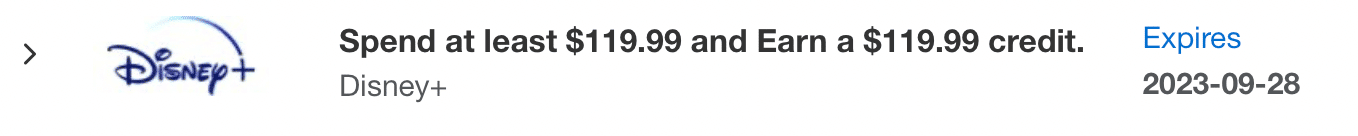

Likewise, when a Disney+ credit showed up, even though I don’t really watch much TV, I subscribed and gifted it to my little cousin – easy way to bring joy to someone you love without out-of-pocket spend.

Amex’s premium credit cards, including the Platinum, Business Platinum, and Aeroplan Reserve, reliably get the highest-value and most-flexible Amex Offers.

If you can anticipate these year after year, you can effectively treat them as a statement credit to offset the cost of your annual fee. That certainly makes it a lot easier to keep a card with a high annual fee long-term for the ongoing benefits.

Additionally, Amex’s strong ties to Marriott Bonvoy inspire frequent Amex Offers for spending at a Marriott property. This can significantly offset your travel costs, especially when the value of hotel points is dropping.

Simply put, keep tabs on your Amex Offers. Whether you keep a card long-term or cancel before the second annual fee, there’s no reason to ignore easy value.

And yes, the famous “Spend $10, get $5” Shop Small era encouraged some… creativity. I’ve split a tennis racket and a protein powder haul into $10 swipes to max the credits.

It worked and it was fun, but also a bit embarrassing and time-consuming. Do it sparingly and off-peak when you can; the bigger one-shot offers usually do most of the heavy lifting anyway.

For the most part, Amex is still the only major Canadian bank offering meaningful rewards on specific purchases.

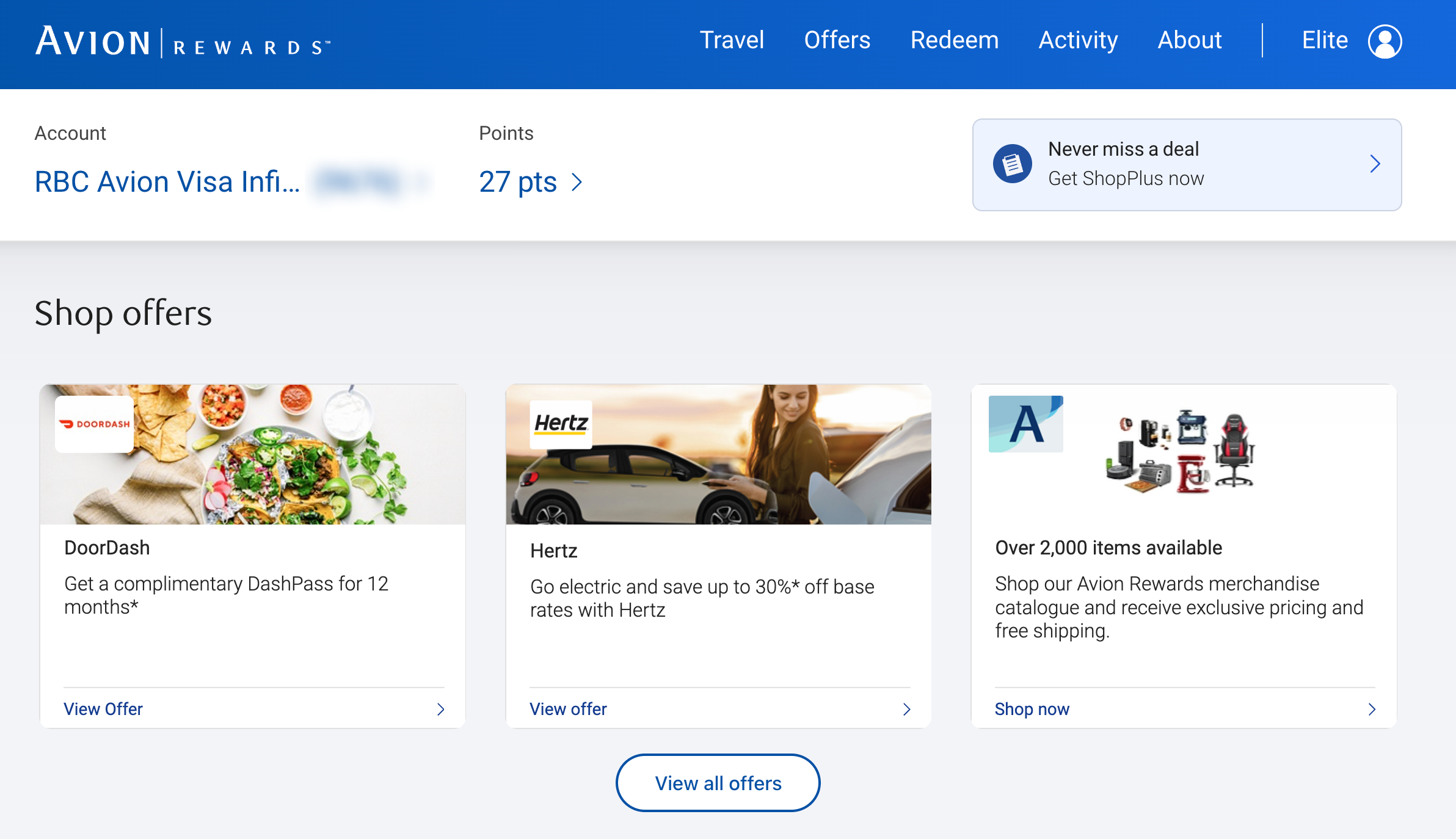

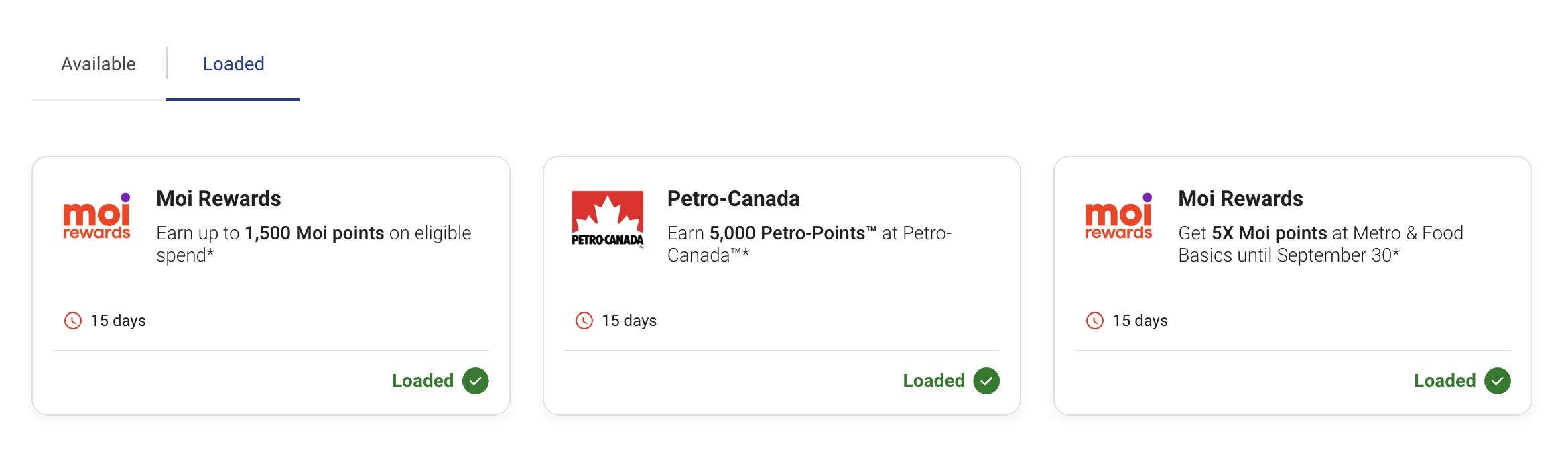

RBC has a similar concept called Avion Offers. You’ll find them under the “Offers For You” link on your card page or in the Avion Rewards website and app.

These offers are similar to Amex’s, with a mix of lump sum rewards, extra rewards per dollar spent, and special partnerships (such as a complimentary DoorDash DashPass). Some offers are automatically registered, while others are opt-in.

However, RBC doesn’t have as many cash back offers, and the value of the kickbacks is usually orders of magnitude less than what Amex provides.

In my experience, standouts have included credits with HP, Microsoft, and Sporting Life; more commonly, you’ll see modest bumps at everyday spots like Metro, Food Basics, Petro-Canada, and Rexall.

In the past, we’ve also seen Air Canada mimic Amex Offers on their co-branded cards with TD and CIBC. In the summer of 2021, Air Canada had a “Spend X, Get Y” offer for cash rebates on Air Canada purchases.

Registration was done via Aeroplan, not the banks, as we see a closer integration of loyalty programs with credit cards.

Smaller fintech startups like Brim and Neo have made partner-based bonuses the foundation of their rewards programs. I’m lukewarm at best towards the concept, though it seems to be the popular approach among the innovators in the payments space.

Hopefully these and other programs will take cues from Amex and deliver real value to their members, such as high rebates with appealing brands or 100% rebates for generalized purchases.

Conclusion

Amex Offers are yet another great way that American Express provides meaningful value for its members.

They come in all shapes and sizes, and any cardholder should be on the lookout for these additional ways to squeeze a bit more value out of their credit card strategy.

While today’s offers are more targeted and less generous than years past, no other Canadian bank matches the depth or frequency; used well, they can be a strong reason to keep your Amex cards long-term.