The Scotiabank Gold American Express ® Card is one of the very best pound-for-pound travel cards in the Canadian market, thanks to its generous earning rates, no foreign transaction fees, and various travel benefits.

With the card packed full of features and advantages, you might be questioning how you can get the most out of the card and really take advantage of all that it needs to use.

In this guide, we’ll reveal you how to maximize the capacity of the Scotiabank Gold American Express ® Card, including by earning and redeeming rewards and whatever in between.

1. Get a Kickstart with the Welcome Bonus offer

You’re off to a fantastic start in optimizing your Scotiabank Gold American Express ® Card with its welcome reward. Presently, new cardholders can make as much as 50,000 Scene+ points,

The first batch of Scene+ points is made upon meeting a modest minimum spend requirement of $2,000 within the first 3 months of the card account opening.

The 2nd batch of Scene+ points is made upon investing a $7,500 within the very first year of card subscription.

While $7,500 might sound steep, it exercises to just $625 a month– a possible target for numerous households, particularly if you’re utilizing the card for groceries, dining, gas, and costs.

On top of that, the $120 yearly cost is waived in the first year, and the individual yearly income requirement is a modest $12,000 annually– abnormally low for a card with this level of benefits.

Whether you’re a student with a part-time task or a newcomer to Canada just starting, this is a strong card that’s definitely worth considering.

Scotiabank Gold American Express ® Card

- Earn 30,000 Scene+ points upon investing $2,000 in the very first 3 months

- Plus, make an extra 20,000 Scene+ points upon spending $7,500 in the very first year

- Earn 6x Scene+ points at Sobeys, IGA, Safeway, FreshCo, and more

- Plus, earn 5x Scene+ points on groceries, dining, and home entertainment

- Also, earn 3x Scene+ points on gas, transit, and choose streaming services

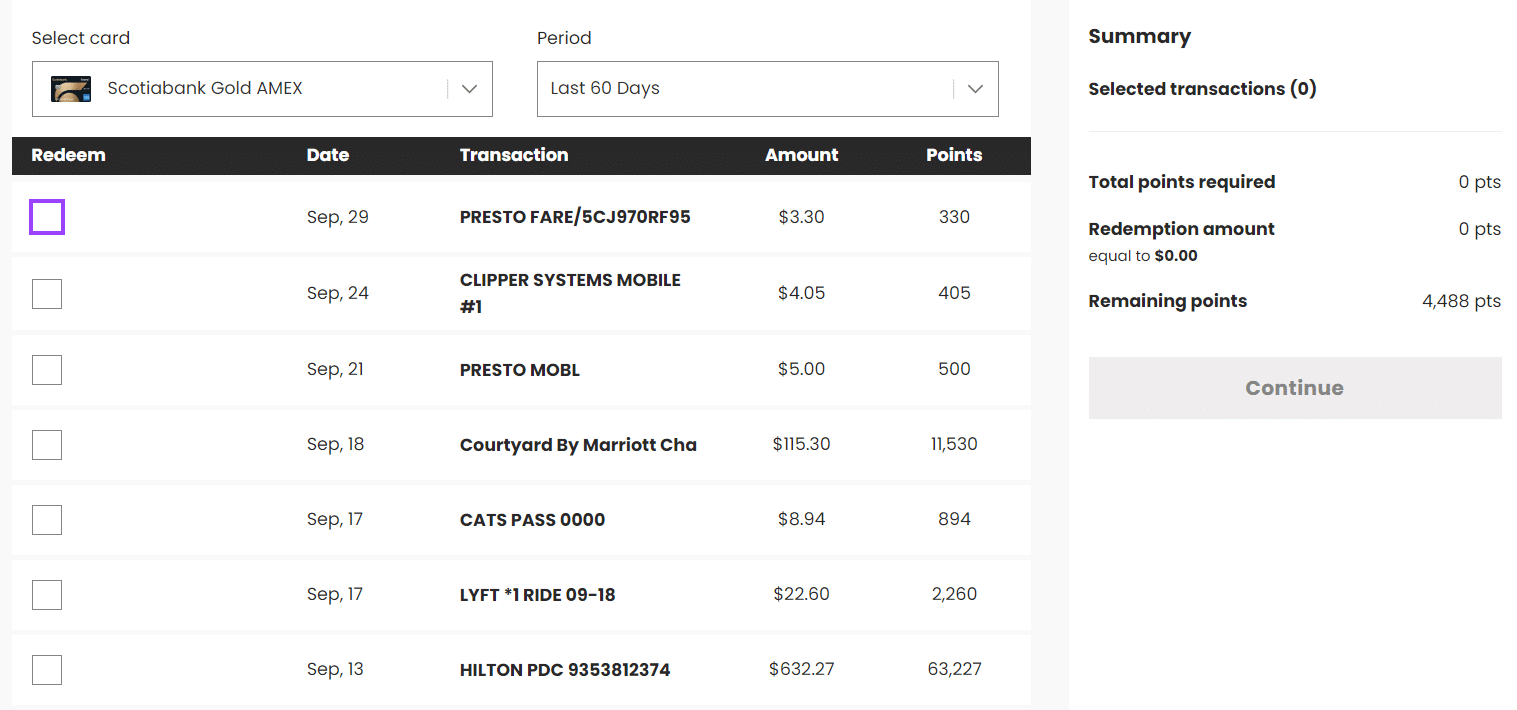

- Redeem points for a declaration credit for any travel expense

- No foreign deal fees

- Take pleasure in the special benefits of being an American Express cardholder

- Yearly charge: $120 (waived for the first year)

2. Increase Your Balance on Everyday Costs

Once you’ve made the full welcome benefit on the Scotiabank Gold American Express ® Card, you can continue to pad your Scene+ balance with the card’s outstanding everyday earning rates.

By spending for a lot of life’s basics with your Scotiabank Gold American Express ® Card, you can take pleasure in the following earning rates:

- Earn 6 Scene+ points per dollar spent at Empire Business supermarket † (Sobeys, Safeway, FreshCo, and more)

- Earn 5 Scene+ points per dollar spent at eligible restaurants and supermarket †

- Earn 5 Scene+ points per dollar spent on qualified home entertainment purchases †

- Earn 3 Scene+ points per dollar invested in qualified gas and daily transit purchases †

- Earn 3 Scene+ points per dollar invested in qualified streaming services †

- Earn 1 Scene+ point per dollar invested in all other qualified purchases (including foreign deals)†

The card is backed by the Scene+ program, which permits you to earn and redeem points at an elevated rate at a myriad of partners, such as:

- Empire Company stores (Sobeys, Safeway, FreshCo, Lawton Drugs, etc)

- Dish Unlimited dining establishments (Harvey’s, Swiss Chalet, East Side Mario’s, etc)

- Cineplex (consisting of The Rec Space and Playdium)

- Home Hardware

Similarly, the Scene+ program permits you to flexibly redeem your points towards travel purchases, product, and present cards, among other options. The versatility of Scene+ points is also significant in that you’re able to utilize your points for expenditures like store hotels or low-priced flights that aren’t bookable through airline or hotel loyalty programs.

The card is likewise backed by American Express, which is accepted in 160+ countries and territories– even in countries that you believe it might not be, such as Nicaragua, Peru, Vietnam, and Kazakhstan. In addition, in Canada, more organizations are accepting American Express thanks to efforts like Shop Small.

3. Approximately 6x Scene+ Points on Groceries

The Scotiabank Gold American Express ® Card offers among the highest earning rates on groceries amongst Canadian charge card. By utilizing your card at qualified supermarket, you’ll take advantage of the following earning rates:

- 6 Scene+ points per dollar spent at Empire Business’s brand names, consisting of Sobeys, Safeway, IGA, Foodland, FreshCo, and Thrifty Foods

- 5 Scene+ points per dollar spent at all other eligible grocery stores

Even much better, as partners of the Scene+ program, Empire Company supermarket let you earn more points with weekly specials and promotions. You can find a number of these offers by browsing the digital or print leaflet of your preferred Empire Business grocery store.

For instance, you can participate in the weekly Scene+Stock Up offer at Sobeys and easily receive countless extra points by simply buying the included items.

Bear in mind that you might also redeem your Scene+points for an instant rebate on your groceries at Empire Company stores at a rate of 1,000 points = $10. Moreover, you can make and redeem Scene+ points on the very same deal and truly maximize your savings.

4. 5x Scene+ Points on Dining and Entertainment

Another amazing feature of the Scotiabank Gold American Express ® Card is its faster earning rate of 5 Scene+ points per dollar invested in eligible dining and entertainment, which enables you to quickly develop your points balance when enjoying a night out.

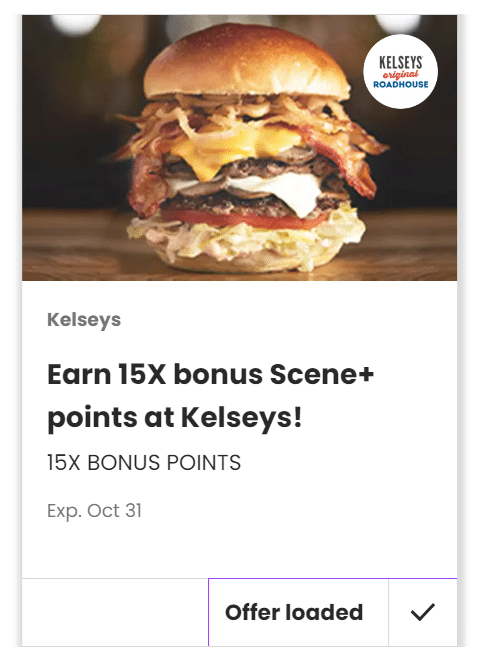

To optimize the number of points you earn beyond those made with the charge card, you can use the Scene+ app to watch for offers from partnered Recipe Unlimited dining establishments and utilize these to make approximately 15x more points on qualified deals.

For instance, you might load the 15x offer at Kelsey’s Original Roadhouse and make 15 Scene +points per$3 spent. Plus, these revenues are on top of what you earn with the Scotiabank Gold

American Express Card, with which you’ll get another 15 Scene+points per$3 spent. That means that by integrating the special deal and costs on your Scotiabank Gold American Express ® Card, you’ll make 30 Scene+ points per$3

spent, which is comparable to a 10%return on costs– amongst the most generous rewards you’ll obtain from a dining establishment in Canada. Your motion picture nights will also be more satisfying when you utilize your Scotiabank Gold American Express ® Card in tandem with your Scene+membership at Cineplex.

By utilizing your Scene+ membership alone, you’ll make 5 points per dollar spent on tickets, food, and drinks; however, when you utilize your Scotiabank Gold American Express ® Card to pay, you’ll get another 5 points per dollar spent on the exact same purchases, doubling your profits to 10 points per dollar spent, or when again, a 10% return.

5. 3x Scene+ Points on Gas and Daily Transit

Another valuable accelerated earning rate on the Scotiabank Gold American Express ® Card is the 3x Scene+ points made on qualified gas purchases and day-to-day transit.

You’ll find this benefit specifically important these days, because PRESTO, the payment system for many transit firms in Ontario, now accepts charge card tapped directly onto its payment gadgets.

You can now tap your card straight onto PRESTO fare gadgets in Ontario That implies that when you take the bus, streetcar, and train in Toronto, you can tap your Scotiabank Gold American Express ® Card straight onto the PRESTO gadget and easily make 3 points per dollar invested in your fares, which is comparable to a 3% return.

You can now tap your card straight onto PRESTO fare gadgets in Ontario That implies that when you take the bus, streetcar, and train in Toronto, you can tap your Scotiabank Gold American Express ® Card straight onto the PRESTO gadget and easily make 3 points per dollar invested in your fares, which is comparable to a 3% return.

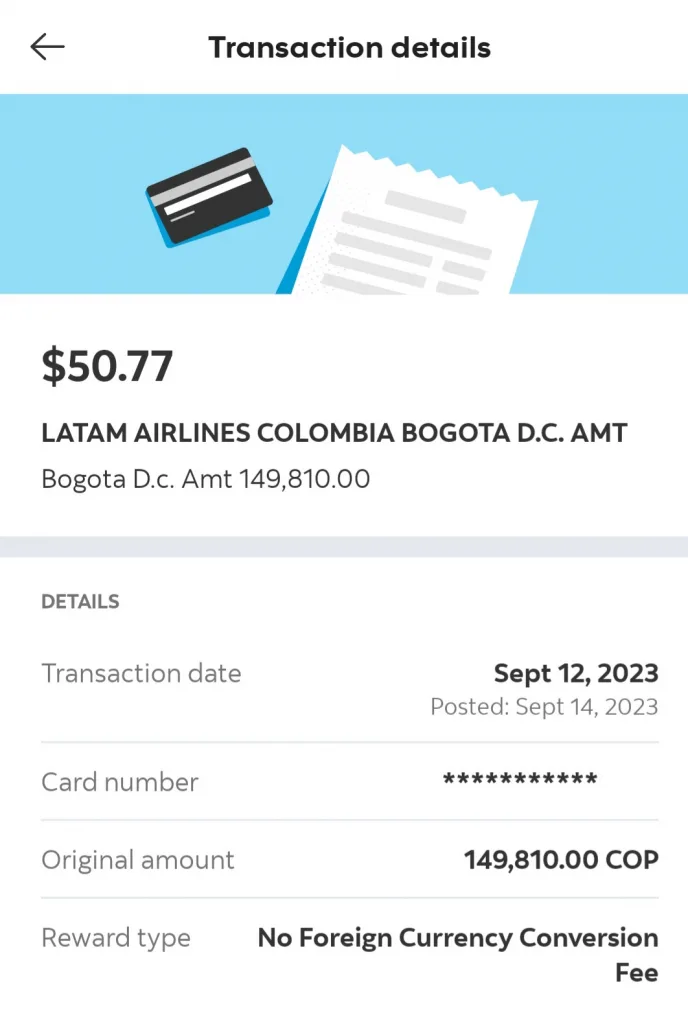

6. No Foreign Deal Costs

Among the most compelling features of the Scotiabank Gold American Express ® Card is that it does not charge a foreign transaction charge on purchases made in foreign currencies.

This means you’ll pay your foreign currency deals based entirely on the mid-market currency exchange rate, with no additional costs added.

The majority of Canadian charge card charge 2.5 %or more on foreign transactions, so if you tend to spend a great deal of time beyond Canada,

these extra fees can really add up. With the Scotiabank Gold American Express ® Card, you’ll not just conserve the 2.5% on all foreign currency deals, however you’ll also make 1 Scene+ point per Canadian dollar invested in all foreign currency transactions (calculated after the currency exchange).

Scotiabank Gold American Express ® Card

- Earn 30,000 Scene+ points upon spending $2,000 in the first three months

- Plus, earn an extra 20,000 Scene+ points upon investing $7,500 in the very first year

- Make 6x Scene+ points at Sobeys, IGA, Safeway, FreshCo, and more

- Plus, make 5x Scene+ points on groceries, dining, and entertainment

- Likewise, make 3x Scene+ points on gas, transit, and choose streaming services

- Redeem points for a declaration credit for any travel cost

- No foreign transaction charges

- Enjoy the unique benefits of being an American Express cardholder

- Annual fee: $120 (waived for the first year)

7. Complimentary Concierge Service

While the Scotiabank Gold American Express ® Card is attractive for its high earning rates, it’s likewise supplemented by a slew of functions that you can make the most of for your travels.

One of these handy functions is the complimentary concierge service, which Scotiabank offers in collaboration with 10 Way of life Group.

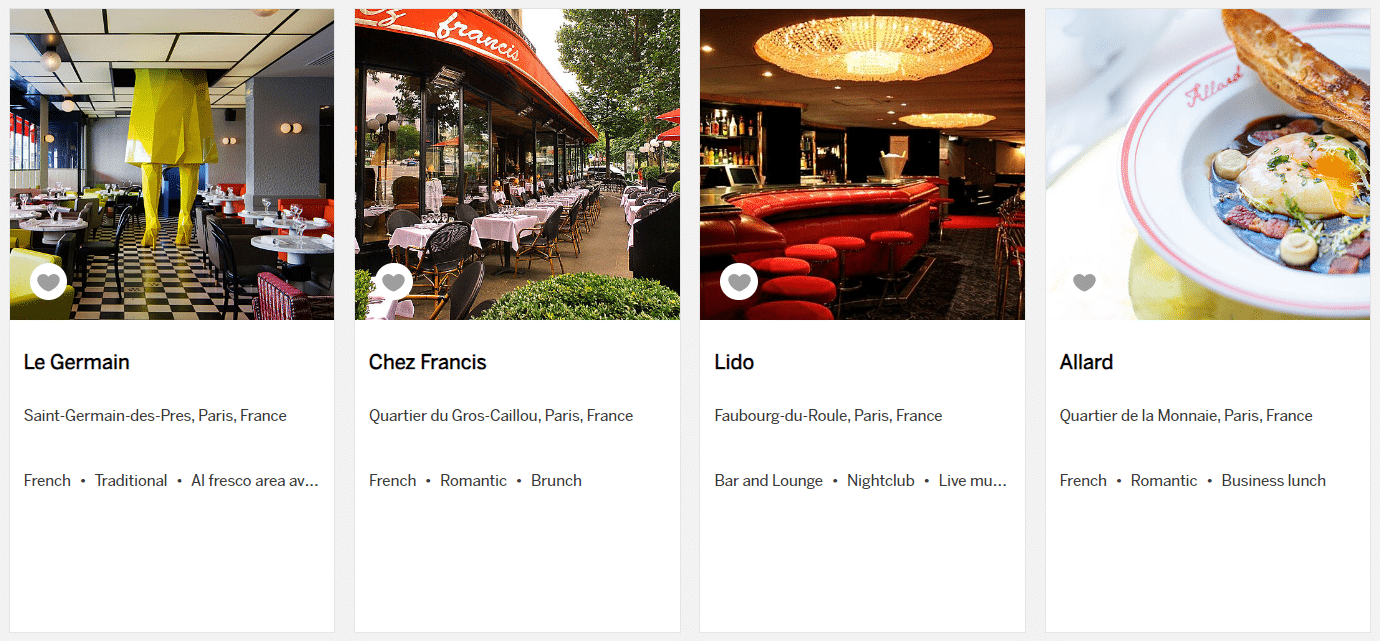

The concierge service can assist you in scheduling restaurants, hotels, and home entertainment (among other services) in Canada and worldwide. As a matter of fact, the service has experts for each geographical area who are geared up to supply customized suggestions.

As an example, this service can eliminate the inconvenience of connecting with restaurants and hotels that are in a various time zone or that speak a various language. In addition, the concierge service offers unique benefits such as complimentary white wine at restaurants, experience credits at hotels and resorts, and unique VIP tickets for sporting occasions.

< img src ="https://princeoftravel.com/wp-content/uploads/2024/10/image2-1.png"alt="" width= "1379"height=" 643 "/ > 8. Amex Provides American Express is understood for its deals that assist offset its credit cards’yearly fees. Thankfully, with the Scotiabank Gold American Express ® Card, you can easily participate in these deals because you can sign up for Amex Uses through a devoted portal.

Some examples of popular Amex Offers include a $60 statement credit upon spending $250 at Marriott-affiliated hotels in Canada and the United States, as well as a $150 statement credit when you invest $750 with United Airlines. In both these cases, the Amex Deal essentially lets you save as much as 20% on the associated flights and hotel stays.

If you have the ability to benefit from these Amex Offers and more over the course of a year, you’ll more than balance out the Scotiabank Gold American Express ® Card’s modest $120 annual fee.

Conclusion

The Scotiabank Gold American Express ® Card is a powerhouse for everyday spending, in your home or abroad, especially if you eat out, purchase groceries, or travel even semi-regularly.

It’s rare to find a card that integrates strong make rates, no foreign deal fees, and a low earnings requirement. Throw in a generous welcome bonus, access to Amex Offers, and useful perks like concierge service, and you’ve got a card that actually pulls its weight.

If you want a flexible card that provides great value without including intricacy, this one’s a strong pick for your wallet.